Investing for child planning is always a grave concern for parents. Due to emotional attachment, they are lured with all kind of products in the name of child future and so at times it’s difficult to choose the right option. Insurance companies have been long selling their child plans with some additional features then a normal insurance product. Good or bad, they have been the attractive buy.

Mutual funds too have schemes dedicated to child planning. The aim of these schemes is to ensure the funds earmarked for child future are utilized only for the objective. But there are many factors which need to be considered before you can make a decision.

Let’s review how these schemes have performed and are they considerable for your child investment portfolio-

What are Children’s Mutual Funds Schemes?

Mutual Funds have specific schemes with name of children funds. These schemes are hybrid funds and either equity oriented or debt oriented. The equity oriented schemes have a higher exposure to equities but the ratio varies among all the schemes. For e.g. in HDFC Children Gift Fund-Inv Plan the equity allocation varies from 40-60% while in UTI CCP it can go up to 100%. The variation of these equity exposures also bring variance in the performance. On other side there are debt oriented children schemes which aim to provide lower risk to the investors and steady returns for meeting short term objectives. Although these too have equity exposure but it is restricted to 0-40%.

Lock-in

Most of these children funds have a lock in period to ensure the investment is held for long term. In HDFC Children Gift fund parents cannot withdraw fund till the child attain 18 years of age or three years to allotment, whichever is later. Similarly ICICI Child Gift Plan charges an exit load of 1% if redeemed money before 3 years. Even other funds too have either lock in or exit loads. All such options are primarily to discourage any short term withdrawal as the funds are aimed for meeting child goals.

Other Features

Some of the child funds provide insurance benefit. But these are majorly accidental insurance which is not very appealing.

Performance

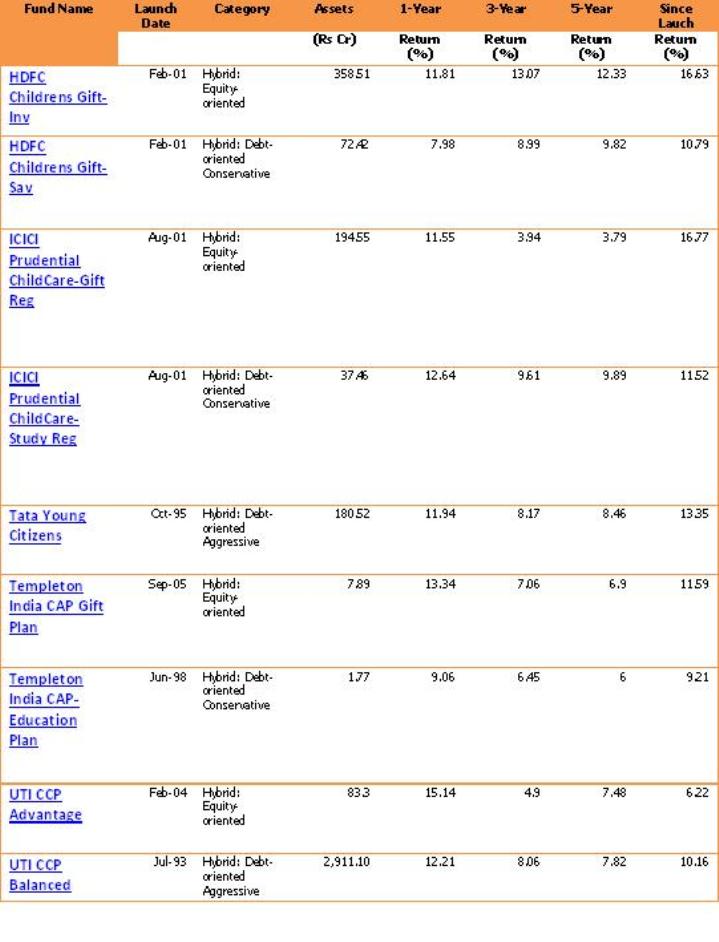

One of the biggest disappointments in these schemes is the corpus size. Barring UTI CCP Balanced no other fund has reached any milestone and in fact most of them has negligible corpus in their books. With such small corpus size the risk is always there for the investors. The returns have also been one of the major factors of non-consideration. Only HDFC and ICICI have been able to deliver reasonable performance.

Performance of Children Schemes as on 09-05-2013

Source: Valueresearchonline

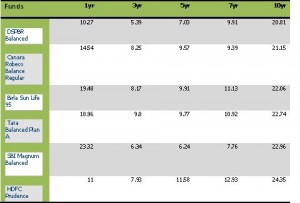

When you compare them to Balanced Funds (Where equity exposure remains above 65%), the choice of children schemes gets lower down . With a judicious mix of equity and debt, the balanced funds are able to deliver superior performance. One more factor which goes in their favor is the tax efficiency as the long term gains i.e. above one year is nil in equity. On other hand child funds can reduce the equity exposure to below 65% which makes them a debt fund when it comes to taxation of gains. There might be other benefit of tax deduction such as 80C, but it is hardly in consideration when you see the number of instruments included in this section alone.

Long Term Performance of Balanced Funds (%) as on 09-05-2013

Source: Valueresearchonline

Planning for child future is full of emotions and you do not have a choice to defer it. But for any long term investments a careful thought needs to be given on various factors which can affect your decisions. It’s difficult to achieve any long term goal with one MF scheme and that’s why most children schemes fail to attract investors. Asset allocation has always been the ideal approach and even within equity mutual funds you have category of schemes to create a well-diversified portfolio. Include these schemes if you want to create that discipline but do your research to choose the right one.

Have you planned for your child future?

Share your views…..

Leave a Reply