A downside protection is more important for success of any investment portfolio. Simply because if your investments falls more than your underline avenues, you may need to double/triple your returns to bring it again into positive territory. However, while investing, we lay more thrust on maximization of returns. The past returns become the parameters in taking investment decisions and expectations are built accordingly. We are ready to take that extra mile of risk to generate the returns which we desire. As a result we end up making our portfolio more volatile than even our risk tolerance. At times it even leads to a panic situation when the fall in your portfolio is beyond your expectations.

The Risk of More Downside in Your Portfolio

The higher downside your investment portfolio will have the larger will be erosion in your wealth. So to recover this erosion you will need to generate returns accordingly. Let’s understand this from a simple example. Say you have invested Rs 10000 and expect a 10% return p.a. from your investment. At the end of year you expect to have Rs 11000. But the underline market falls and your investment goes down by 10%. Now value of your investment is Rs 9000. First it need to reach level of Rs 10000 to break-even. This can be achieve only if you generate 11% or higher returns on your portfolio i.e.

Earning Required now – 9000*11.2%= 1080

Value of Investments post returns= 9000+1080= 11080

*All figures in Rs

(For simplicity I have assumed yearly return)

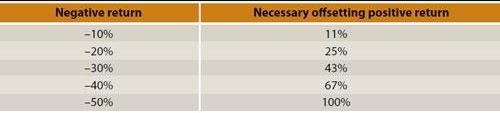

The below chart shows how the larger downside will increase your return requirement to offset the erosion your investments have incurred.

As you can see, to offset -10 % the return required will be 11% which we have calculated above. But if your portfolio goes down by 50% then the return required to reach the same level is 100%. This will be difficult to achieve and so the underline markets may recover but you will still be managing losses in your portfolio. The other impact will be on wealth creation as more downside means it will take more time to recover your losses. As a result, the positive return you generate in such case will be far lower than you expected and the so will be the wealth generation.

Ensuring Downside Protection

It’s difficult to create a portfolio where you can maximize the upside and minimize the downside. This is more easier said than done. So you have to work both on return expectation and build strategies for reducing the downside of your investment portfolio. Ideally such investment portfolio do not experience extreme movements on either side i.e. downside or upside.

- Diversification– Laying all your eggs in a single basket is never a good idea and so your investment should be diversified by allocating it to various asset classes matching your requirement. Which assets you choose will depend on various factors such as risk tolerance, time horizon of your goals and others. But following this approach you ensure you do not expose your surplus to the volatility of any particular asset thus minimizing the risk of higher downside. Even within assets classes such as equities & debt there are various categories to choose from where you to make a wise selection. A core & satellite strategy has been a time and tested strategy for creating an investment portfolio. It is based on making a core with long term investments which can achieve your gaols. You can read more about the strategy here – Core & Sattelite

- Return Expectation– It’s one of the major reason why we tend to deviate from our objective. Keeping our return expectation high from the avenues generating variable returns we invest in categories which can derive those return but may not match our . Rather our return expectation should be based on our goals and objectives we need to achieve and the risk we can tolerate in our portfolio. This will make it more realistic and ensure our investment portfolio is created to meet our goals within the boundaries of our risk tolerance.

Managing risk within your investment portfolio is a critical element. Aiming only for upside can leads to dissatisfaction in later years as higher returns comes with higher risk. So create an investment portfolio which is capable of withering the downside and is able to generate you returns for creating wealth which you need to fulfill your goals and dreams.

Leave a Reply