RBI and then SEBI recently gave its nod for acceptance of e-KYC where you can authorize any service provider to receive your documents such as identity proof and address proof electronically. Through this service now you can invest in shares, mutual funds, open demat account and do other market related transaction without waiting for days to first get KYC done. The service ensures the instant verification of your credentials, required to utilize various financial transaction services.

How e-KYC works?

e-KYC is a service by UIDAI which creates Adhaar card. Individuals who have their adhaar number can easily avail this service for doing financial transactions which reduces the time lag in verification of your documents, as present in physical KYC.

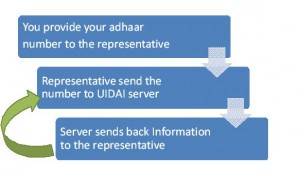

The process is highly simplistic. When you visit the respective company where you are interested in making financial transaction, you give your adhaar number to the person representing the company. The representative feed the number and send it to UIDAI e-KYC server for verification. The server at UIDAI verifies from adhaar number your credentials and send back your information (only demographic) back to the representative who has seeked information. The information will include your Name, DOB, Age, Address, Mob no and Email. Once the representative receives the information on his/her computer your verification process gets completed. To ensure your data is not misused, the information in front of the person verifying your credentials remains only for few minutes.

Larger Benefit

The other bigger advantage of e-KYC is going to be in the banking industry. This service will be utilized in many government sponsored programmes where subsidy is provided such as to BPL families, in LPG connections etc. Since subisidies are going to be directly credited to beneficiary account, e-KYC will ensure opening of new bank accounts without any hazzle. As KYC can be performed at any agent location using biometric authentication or remotely using an OTP on a website or mobile connection, it eliminates the process of visiting banks by the beneficiary.

This is how it will work-

A request for instant a/c by the benficiary is given to the nearby Bank Correspondent using biometric machine. The information (Adhaar + Biometric) is sent by the BC to the respective bank from where it goes to e-KYC service agency. From service agency the request goes finally to the UIDAI e-KYC services. On receiving the Adhaar number along with biometric details, the server sends back the demographic information to the agency from where it goes to the bank. The bank on receiving the required information activate the account instantly and the beneficiary receives the instant account kit.

Thus, e-KYC service has given a new medium to the banking services which will be faster. Even individuals without adhaar number will be able to utilize this service through the process explained above.But initially this intend to benefit larger group who ahve obtained their adhaar number and are going to be beneficiary of any government sponsored programmes.

Ease of Investing

e-KYC has made investing very easy now. Before it was a lengthy process which even involved visiting the office of the agency and producing your original documents required for verification. This verification takes a good time and many new changes in rules made it more cumbersome. But e-KYC has eliminated all this and now to open a demat account, investing in mutual funds and for many other investment avenues, the KYC can be done instantly.

e-KYC is a welcome move. However, one need to know that there may be errors in one’s adhaar card. For this the agency which is verifying your credentials will not take responsibility as has been indicated by some banks. So ensure your Adhaar card has the correct information.

Overall, you can expect faster service when you go for investing your money, especially for the first time.

Leave a Reply