Finally, LIC has launched its online term plan LIC e-Term. Many of us would have waited since the company announced its intention to do so. As the awareness of life insurance has increased among masses, the online term insurance has seen a steady growth. LIC already holds a big market share and so the launch of this product is looked at with a great interest. But as I have always stated, its wiser to review any product on various parameters before you make any decision. Considering all insurance companies have now an online term plan in their product basket, it’s going to be a tough competition even for this mammoth.

Let’s see how LIC e-Term compares with its peers and is there anything new introduced by the company –

Features of LIC e-Term

LIC new online term plan is named as LIC e-Term. The product name itself justifies it is going to be bought online and so there will be no agent involved. It’s a pure term insurance i.e. there is no maturity value in the product. On the death of the life insured the sum assured is paid to the nominee. There are no additional riders you can attach to this product. LIC e-Term is available through LIC Direct but is offered with few restrictions.

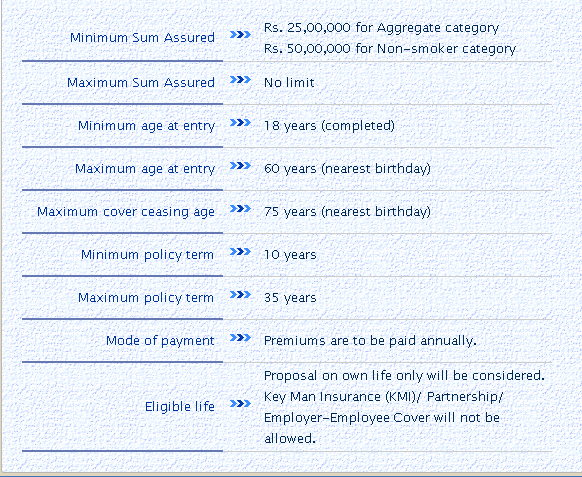

Eligibilty

Although the eligibility is much similar to other online term plans available, there are few key points to note:

Category

The term plan is divided into two categories – Aggregate and Non-Smoker. Any individual other than Non-Smoker will fall in the Aggregate category and is much similar to its offline term insurance. Surely the premium rates vary within these two categories and with a wide difference.

Who Can Buy?

LIC e-Term can be bought for self only. This means you cannot propose it on any other life. Even Key-Man Insurance, Partnership, Employee-Employer relationship is not applicable in this product.

Premiums Modes

This is a main restriction in the product. Unlike other life insurers online term plans, you can pay your premiums in LIC e-Term only in the annual mode. This may be a big disadvantage to many life insurance buyers who prefer spreading their outgoes, especially when premiums are high.

Premium Rates

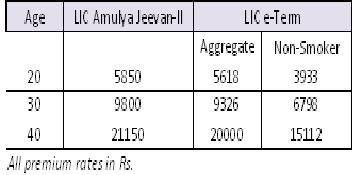

Its the most important aspect since many decisions will be based on the premium rates. The comparison is not only with LIC peers but even with LIC Amulya Jevan II which is sold only through agent.

With LIC Amulya Jeevan-II

The premium rates have been taken from LIC website and for life insurance coverage of Rs 50 lakh with 25 year term . (The term rates for LIC Jeevan Amulya-II are sample rates from LIC website)

As can be inferred from the above table, the premium rates for e-Term Non-Smoker category are surely very low. But for other category the difference is not much to reckon with. So if you have bought LIC term insurance policy through an agent only a non-smoker can derive benefit from LIC e-Term. However, the age you bought your term insurance policy should also be taken in consideration.

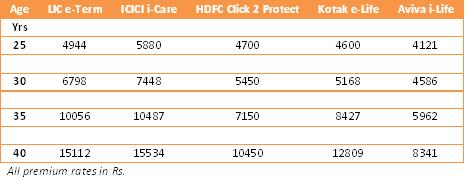

With Competitors

The premium rates are for non-smoker category for a life insurance coverage of Rs 50 lakh with 25 years term. (All premium rates are taken from companies website)

Looking at the chart above it can be easily seen that LIC is not one of the cheapest term plan available. In fact it goes more closer to ICICI i-Care where premium are higher. But ICICI does not have any medical test and so the additional premium is for the risk company is taking. If LIC insist for medical test at this premium rates then will it not be costlier than ICICI?. The other companies HDFC, Kotak and Aviva are offering much lower premium rates than LIC. If you are compelled to buy under aggregate then the premium rates for LIC e-Term are as good as LIC term insurance policy through an agent. Then difficult to compare with online term insurance premium rates.

Should You Buy

LIC has its name and many trust the company for the government ownership. If we leave aside the sovereign guarantee then premium rates are surely not attractive as it was expected. The claim ratio has been a strong contention for this company but that is also being contested now by few private companies who have come closer to this mammoth. So for LIC insurance buyers it is going to be a tough decision – whether to pay the additional premium just for the government stake.

Term plan is a lifetime decision. You do not switch term insurance frequently as it is a long term product and premium rates increase with age. Buying only for sovereign guarantee and neglecting your outgoes may not be a wise decision. Stick to the basics, compare on different parameters and then take a decision. However, if you have been just waiting for LIC then its better to buy the term insurance today and not leave yourself uninsured anymore. As for existing policyholders, do take note the actual difference in your outgo and then decide. In all probabilities, always exit your existing insurance policy only when you have bought the new term plan as sometimes medical tests can bring out few issues for which you may be charged extra by the company.

What do you think about the product? Will LIC be still your preferred choice?

Share your views in the comment section …

Leave a Reply