It’s being two years since direct plans in mutual funds came into being. Much has been debated on these investments as to whether they are really helpful for the investors or not. The intermediaries are against it since it threatens their survival while it makes a strong proposition for financial planners as it allows them to save more for their clients. Look at more closely then you realize direct plans are actually benefiting investors. The difference they are producing might look paltry in just two years but even if you do some assumed calculations it does brings a great deal of difference in the long term. Moreover, with IA regulations in place the direct plans make a case for all investors as the advice is now separated completely from the product buying.

Why Direct Plan Benefits?

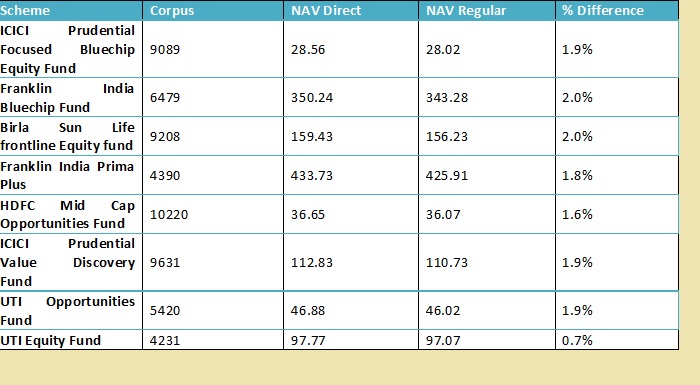

There is no element of doubt that direct plans in mutual funds are benefiting investors. A .5-1% difference in the recurring expenses is good enough to create a notable difference in the accumulation especially for small investors. Say you start investing R 10000 monthly and are aiming to contribute for 25 years. The accumulation at 9% returns will be approx. Rs 1,06,53,085 while at 9.5% it goes up to Rs 1,15,05,144 thus bringing a difference of Rs 8,52,060 which is substantial enough. Increase the difference in return up to 1% i.e. earning a 10 % return the accumulation on this SIP will be approx. Rs 1,24,31,241. A difference of Rs 17,78,156 is created with a difference of 1% return. That’s compounding effect which we say is the eighth wonder of the world. This simply means that if you are charged .5% less and your returns gets boost up by same amount then it helps you in accumulating a higher corpus in the long term. So will you forego this additional accumulation in your corpus?. If you are asked to invest in regular plans the rationale behind it should be strong enough to justify let go the difference. There are reasons too which has been put forward by many which I will take up next but before it just check the difference in regular and direct plans which exist today (data as on 12/06/2015) :

Why Against Direct Plans?

Now comes the debate. There are many reasons put forward against the direct plans especially by intermediaries whose revenue comes from it. These reasons upfront looks to be true but when you analyse them then they are not satisfying enough to force you to forego the benefits.

Here are most common of them :

The Selection of Schemes

The first argument against direct plans is that investors will not able to benefit as they will be left to do the selection for themselves and most will not be able to select a right mutual fund scheme due to lack of awareness. But IA regulations have resolved this. If it’s just the case of selecting a mutual funds scheme without any advice being needed then the reason may hold. But how many of us invest without any objective and its not also the right approach. There only IA can offer you a detailed investment advice as illustrated under the regulations. So for seeking advice to select appropriate mutual funds scheme based on your financial goals you will have to approach the Registered Investment Adviser who does charge a fee. Once advice is delivered to you the investment adviser do not play any role in executing those investments and so ideally he/she should not have any interest in earnings deriving from it. Now comes the real question – where you should go and execute. The choice is completely. From the viewpoint of Investment Adviser the pros and cons of investing in direct plans should have been explained to you in detail. As I said before there has to be a good rationale to avoid direct plans. For you the solution to the above debate has been given by the regulator- Take advice from IA and choose yourself where to execute. If you are seeking investment advice then selection has already been done, why then forego this difference?

Ease Of Investing and Monitoring Is An Issue

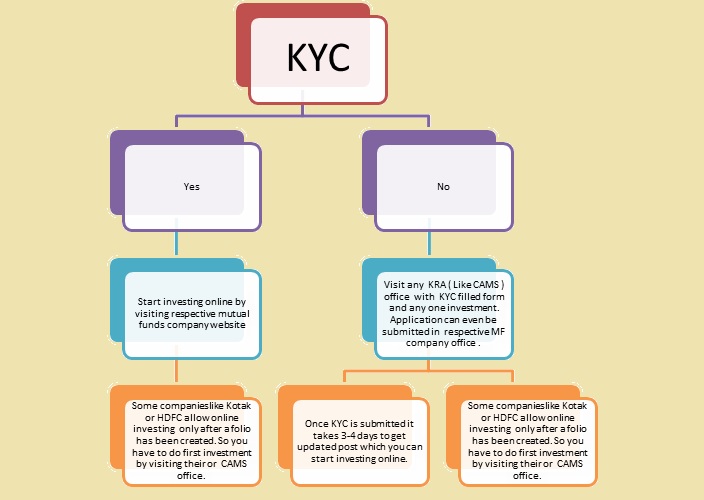

One of the other reason put forward is that investing in direct plans is cumbersome as you have to do lot of paperwork. The ease of online investing is missing as there is no single platform where you can execute. So one has to visit mutual funds company or registrar offices to do so. Also, if the adviser has to monitor your investments in direct plans then it’s difficult for him/her as he/she does not get any data from the company. Contrary to this through intermediaries there are many online platforms which brings ease of investing and he/she can fetch any data anytime to get the information. But is it really so difficult?. As I implemented some of my client’s investment and gone through the process I found that the hurdle is only for the first time investors where some companies allow online investing while with some you have to visit personally. If you are not KYC compliant then you have to do it personally visiting the office and submit your application. Post KYC you can very well invest online although in some companies like Kotak or HDFC you still have to make first transaction offline to create a folio as online investing is only for existing investors. But if you complete the first time investor hurdle then the ease of investing is always there. Mutual Fund Utility and more platforms in near future bound to resolve this hurdle. Moreover, now once you have invested then there are no dearth of tools like Perfios, VR Online, ET, etc.. etc.. to manage your investment portfolio. Even registrar like CAMS has made things simpler by giving you consolidated statements of all your investments on a click of a mouse. For monitoring, the info of your transactions can always flow from your end to your adviser with an ease through CAMS as you are not going to do transactions daily and when you will be charged for monitoring your investments by the IA then it make sense to go for cost saving. So giving some of your time upfront to execute your transactions is worth the savings you are going to make. Even your IA should be able to assist you in the process for a small cost. It also helps you in learning the process which is necessary. Below is how the investment in direct plans follows:

Start Investing in Direct Plans

My advice to investors is go ahead and invests in direct plans. You can very well see the difference. As for investment advice it can only be delivered by SEBI Registered Investment Adviser. Even if you have to do it offline spending time on it will be worth the savings. You may have to visit office of the registrar like CAMS or KARVY but for your convenience they manage multiple companies and so save time for you. Once you are invested then further transactions are much easier and you can do it sitting at your place. The debate against it will be there till both options are present but cannot be a reason for you to forego the difference which has been provided by the regulator. So go ahead and make the wiser choice.

What you think about direct plans? Any hurdle you faced while investing? What your adviser has told you about them?

Share your views….

Leave a Reply